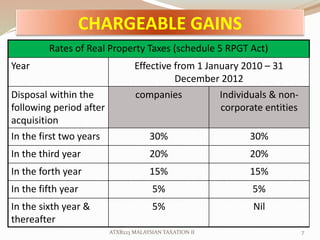

Further to the above on 1 st January 2018 the Finance No2 Act 2017 came into effect with amendments to the Real Property Gains Tax Act of 1976. RGPT rate for 3rd Year 30 RPGT Payable selling price - buying price x RPGT Rate RM700000 - RM500000 x 30 RM200000 x 30.

As such a sum of 7 instead of 3 of the total value of the consideration is to be retained by the acquirer if the disposer is not a Malaysian citizen or permanent resident.

. Stamp duty is calculated on the market value of the property at the time of the acquisition whereas RPGT is calculated on the profit gained from the disposal of the property. How much RPGT Thomas has to pay. In the 4 th year.

It is the imposition of 5 Real Property Gain Tax RPGT for gains received from disposal of properties after the fifth year of owning them. Disposal in 6 th year and subsequent year. Malaysia is a member of the british commonwealth and its tax.

SW 3-6 Sunway College INTRODUCTION RPGT. The new amendment introduced a new subsection to the RPGT Act Section 21B 1A which increased the rate from 3 to 7 for a disposer who is not a citizen and not a permanent resident. How much RPGT Thomas has to pay.

5001 - 20000. Pursuant to the amendments it is worth noting that if you are a foreigner wishing to dispose of. REAL PROPERTY GAIN TAX 1976 RPGT 24 May 2017 Wednesday Venue.

In the announcement of Budget 2014 every property owners have to pay RPGT at a 30 for properties sold within 3 years or less 20 for properties disposed within 4 years and 15 for properties disposed in 5 years. RPGT Exemptions tax relief Good news. 20001 - 35000.

Taxable Income RM 2016 Tax Rate 0 - 5000. 275000 - 103500 - 70005000 x 5 or 275000 - 168000 - 70005000 x 5 Thank you very much. Tax Rates in Malaysia for 2016-2017 2015-2016 2014-2015.

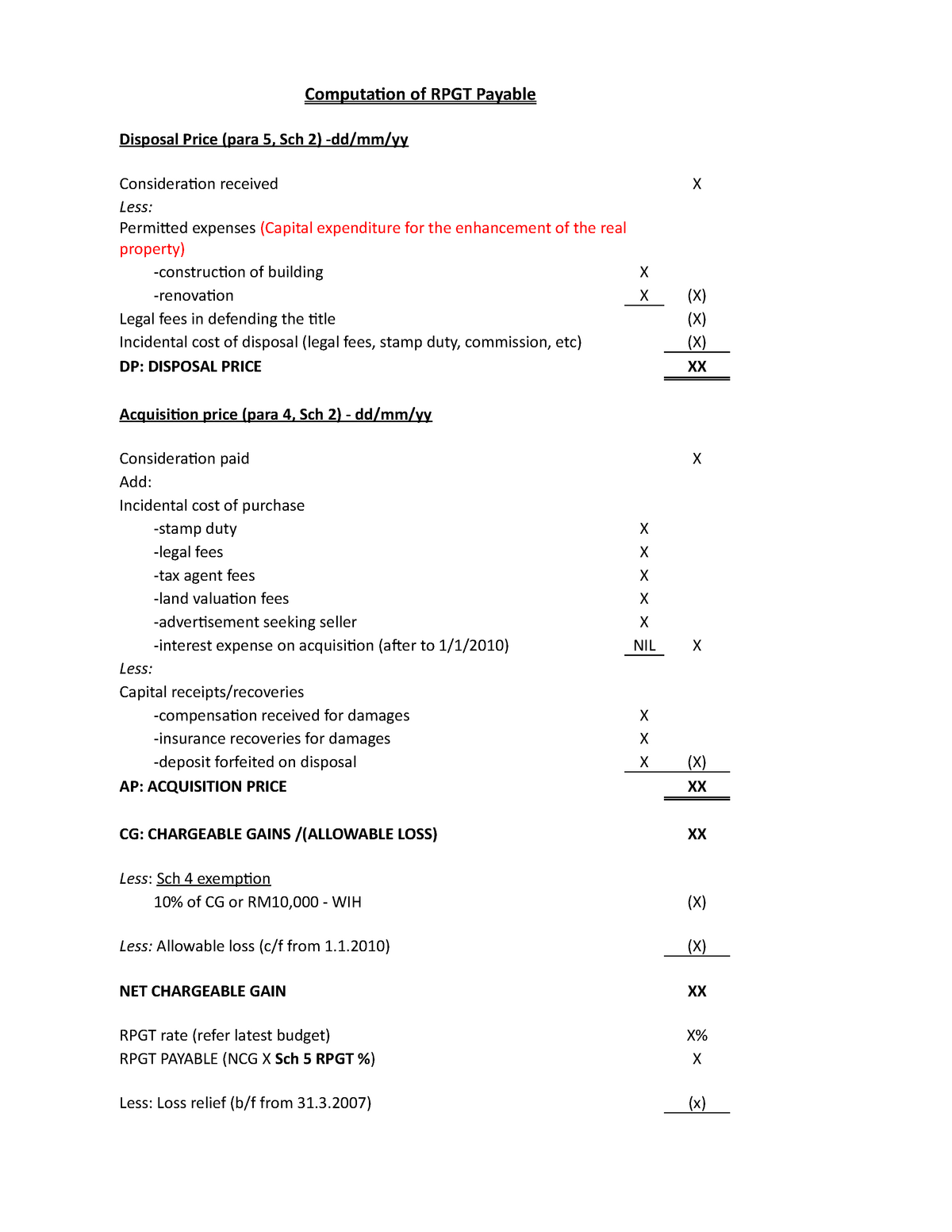

RPGT would then be calculated by multiplying your chargeable gain with the relevant RPGT rate. Miss A purchased a property for RM500000 three and a half years ago and sold it for RM800000. Miss As RPGT RM300000 X RPGT Rate which is determined by.

Since 2014 though RPGT rates have remained the same. For example individual Malaysian citizen and partners. Lets bring this to life with an example.

April 10 2017 Generally an. RPGT is charged on chargeable gain from disposal of chargeable asset such as houses commercial buildings farms and vacant land. Which year is the year of disposal for Thomas.

Malaysia Dates of filing Returns Reporting and Payment. In the 5 th year. These proposals will not become.

Year of disposal date on New SPA - date on old SPA 14 April 2020 - 16 November 2017 3rd Year 2. The main factors that determine which RPGT rate apply to you are. Where the disposer is a company the rpgt rate is 30 if the disposal takes.

RPGT rates Returns and assessment Date of disposal Withholding by acquirer Payment by disposer Exemptions Stamp Duty Basis of taxation Rates of duty Stamping Penalty. Tax Year 1 January to 31 December Tax Return due date 30 April. View Sunway REAL PROPERTY GAIN TAX RPGTpptx from ACC 2054 at Sunway University College.

Above RPGT Rates in Malaysia as of Budget 2014. I believe it impacts a lot more on long-term property investors over short-term speculators who gain from flipping properties. With effect from 1 January 2014 the.

So from tommorow onwards all property sold will be charged the new RPGT rate as stated in Budget 2019This is my scenario how much tax i have to pay if i were to sell my property next year. Part 1 Schedule 5 RPGT Act. With effect from 21101988 RPGT is extended to gain from disposal of shares in real property company RPC ASSET includes any land situated in Malaysia and any interest option or other right in or over such land.

On the other hand if there is a failure to pay the RPGT within the timeframe given a 10 penalty will be imposed on the amount payable. Part II Schedule 5 RPGT Act. There are some exemptions allowed for RPGT.

Is not a malaysian citizen or permanent resident the rate of rpgt is 30. For ya 2017 and 2018 the tax rate for companies and. Miss As chargeable gain would be RM300000.

RPGT rates differs according to disposer categories and holding period of chargeable asset. If you owned the property for 12 years youll need to pay an RPGT of 5. This booklet incorporates in coloured italics the 2017 Malaysian Budget proposals announced on 21 October 2016.

How much RPGT do i have to pay. 342000 RPGT rate 30 RPGT payable 102600 Acquisition Price AP of land PE of the from MAF 503 at Universiti Teknologi Mara. 13 bi Created Date.

All disposals made after such 5-year period are exempt from RPGT. In the 6 th and subsequent years. Companies Trustee 1 Society 3 Individuals Individuals 2 and Executor of deceased estate 2 Companies 2 Within 3 years.

Tax payable Net Chargeble Gain X RPGT Rate based on holding period RM171000 X 5 RM8550. A real property gains tax rpgt applies to the sale of land in malaysia and. If you look at Real Property Gains Tax history in Malaysia the RPGT rates always change depend on the government policy etcUnder the recent Budget 2014 announcement the Malaysian Government has proposed a significant increase to the current RPGT rates to further curb speculative activities in the local real property market.

Youll pay the RPTG over the net chargeable gain. Except part II and part III. The disposer is devided into 3 parts of categories as per Schedule 5 RPGT Act.

RPGT rates in 2016 and 2017 As mentioned earlier the Government has tinkered around with RPGT rates a few times over the last decade or so largely in an effort to curb speculation and property flipping.

Taxation On Property Gain 2021 In Malaysia

Format Of Rpgt Payable Revised Computation Of Rpgt Payable Disposal Price Para 5 Sch 2 Studocu

Understanding Rpgt Legally Malaysians

Understanding The Concept Of Real Property Gains Tax Rpgt Wma Property

Malaysia Finance Blogspot Rpgt Should Not Be Calculated From Year 2000 But 2013

Rpgt For Company In Malaysia L The Definitive Guide 2022 Industrial Malaysia

Real Property Gain Tax Rpgt 2020 Malaysia Housing Loan

2022 Updates On Real Property Gain Tax Rpgt Property Taxes Malaysia

Rpgt For Company In Malaysia L The Definitive Guide 2022 Industrial Malaysia

Real Property Gain Tax Rpgt 2020 Malaysia Housing Loan

Ppt Real Property Gain Tax Powerpoint Presentation Free Download Id 4503504

Rpgt And Retention Sum Policy And Refund

What We Need To Know About Rpgt

Real Property Gains Tax Rpgt In Malaysia Tax Updates Budget Business News

2022 Updates On Real Property Gain Tax Rpgt Property Taxes Malaysia

Zerin Properties Real Property Gains Tax

Rpgt And Retention Sum Policy And Refund

Real Property Gain Tax Rpgt 2020 Malaysia Housing Loan